| Crypto | Price (USD) |

|---|---|

| BIT-27JUN25-CDE | $105,805.00 (-0.34%) |

| BTC-USD | $105,204.98 (-0.31%) |

| YFI-USD | $5,204.48 (-2.50%) |

| LSETH-USD | $2,814.21 (-1.37%) |

| ETH-USD | $2,632.25 (+0.20%) |

| MKR-USD | $1,817.45 (-3.84%) |

| BCH-USD | $404.69 (+0.10%) |

| AAVE-USD | $265.88 (-0.30%) |

| SOL-27JUN25-CDE | $155.00 (-1.66%) |

| QNT-USD | $117.43 (+1.82%) |

| LTC-USD | $88.520 (-2.38%) |

| TRB-USD | $51.260 (+2.36%) |

| COMP-USD | $44.020 (-1.32%) |

| FARM-USD | $30.670 (-1.03%) |

| DASH-USD | $21.550 (-3.97%) |

| AVAX-USD | $20.310 (-5.27%) |

| METIS-USD | $17.630 (-4.75%) |

| ETC-USD | $17.330 (-2.20%) |

| EGLD-USD | $15.660 (-2.31%) |

| LINK-USD | $13.937 (-2.86%) |

| ILV-USD | $12.720 (-2.83%) |

| INJ-USD | $12.223 (-5.54%) |

| TRUMP-USD | $10.970 (-1.70%) |

| ZEN-USD | $10.713 (-7.68%) |

| AUCTION-USD | $10.660 (-2.02%) |

| LPT-USD | $8.8000 (+10.97%) |

| MUSE-USD | $8.7380 (+3.19%) |

| NMR-USD | $8.5500 (+5.04%) |

| MLN-USD | $8.1100 (-2.41%) |

| RPL-USD | $6.3800 (+5.80%) |

| UNI-USD | $6.3630 (-4.89%) |

| ICP-USD | $5.3110 (-0.58%) |

| APT-USD | $4.8300 (-3.21%) |

| ATOM-USD | $4.3130 (-3.04%) |

| DOT-USD | $4.0470 (-3.62%) |

| MEDIA-USD | $4.0400 (-7.13%) |

| RENDER-USD | $3.7960 (-3.56%) |

| RNDR-USD | $3.7920 (-3.58%) |

| SUI-USD | $3.1974 (-2.18%) |

| HNT-USD | $2.9800 (-6.70%) |

| VVV-USD | $2.9600 (-0.67%) |

| PRIME-USD | $2.7380 (-5.65%) |

| CVX-USD | $2.6630 (-1.95%) |

| FIL-USD | $2.5810 (-2.16%) |

| ORCA-USD | $2.5327 (-4.99%) |

| AXS-USD | $2.4670 (-4.60%) |

| NEAR-USD | $2.4580 (-3.04%) |

| ZRO-USD | $2.2530 (-3.80%) |

| OMNI-USD | $2.2340 (-3.79%) |

| XRP-USD | $2.2130 (-1.48%) |

| TIA-USD | $2.1730 (-3.85%) |

| JTO-USD | $1.8422 (-1.13%) |

| CTX-USD | $1.6853 (-5.05%) |

| AVT-USD | $1.5900 (-2.45%) |

| ELA-USD | $1.5090 (-0.33%) |

| EIGEN-USD | $1.4840 (-3.76%) |

| AKT-USD | $1.3090 (-3.96%) |

| INDEX-USD | $1.2300 (-3.15%) |

| UMA-USD | $1.1410 (-5.31%) |

| BAL-USD | $1.0889 (-1.51%) |

| GAL-USD | $1.0310 (-31.59%) |

| BADGER-USD | $1.0200 (-3.77%) |

| PYR-USD | $1.0170 (-1.74%) |

| RLC-USD | $1.0090 (-1.72%) |

| USDT-USD | $1.0005 (-0.02%) |

| DAI-USD | $1.00000000 (+0.01%) |

| PYUSD-USD | $0.99977000 (+0.00%) |

| GUSD-USD | $0.99900000 (+0.00%) |

| PAX-USD | $0.99660000 (-0.54%) |

| RARI-USD | $0.99000000 (-1.00%) |

| LQTY-USD | $0.97910000 (-4.71%) |

| ME-USD | $0.92200000 (-11.35%) |

| PRO-USD | $0.91000000 (-7.49%) |

| WIF-USD | $0.88700000 (-8.84%) |

| LDO-USD | $0.88100000 (+1.73%) |

| ABT-USD | $0.83510000 (+0.14%) |

| ONDO-USD | $0.83272000 (-2.58%) |

| GFI-USD | $0.81500000 (+1.42%) |

| FET-USD | $0.80290000 (-3.01%) |

| IO-USD | $0.79700000 (-4.32%) |

| STX-USD | $0.75800000 (-3.41%) |

| APE-USD | $0.72200000 (+0.28%) |

| RAD-USD | $0.70000000 (-1.41%) |

| PLU-USD | $0.69000000 (-1.43%) |

| ADA-USD | $0.67750000 (-2.49%) |

| BAND-USD | $0.67600000 (-2.59%) |

| SNX-USD | $0.67600000 (-4.11%) |

| SUSHI-USD | $0.66810000 (-5.46%) |

| BNT-USD | $0.65460000 (-1.50%) |

| CRV-USD | $0.64140000 (-7.31%) |

| OP-USD | $0.63300000 (-5.10%) |

| RONIN-USD | $0.58100000 (-3.17%) |

| XTZ-USD | $0.58000000 (-2.03%) |

| HIGH-USD | $0.55500000 (-1.77%) |

| IMX-USD | $0.55270000 (-4.14%) |

| DRIFT-USD | $0.54300000 (-3.72%) |

| ARKM-USD | $0.52600000 (-4.54%) |

| SAFE-USD | $0.49010000 (-6.40%) |

| LIT-USD | $0.47010000 (-54.80%) |

| KAVA-USD | $0.43980000 (+0.23%) |

| SEAM-USD | $0.43950000 (-4.95%) |

| DIA-USD | $0.41125000 (-3.70%) |

| TRAC-USD | $0.40110000 (-4.57%) |

| COW-USD | $0.40010000 (-7.81%) |

| GHST-USD | $0.39000000 (-5.34%) |

| ARB-USD | $0.36190000 (-1.68%) |

| AIOZ-USD | $0.35660000 (-3.12%) |

| ORN-USD | $0.35500000 (-25.89%) |

| KRL-USD | $0.33750000 (-1.14%) |

| KNC-USD | $0.32930000 (-2.14%) |

| CGLD-USD | $0.32600000 (-4.40%) |

| AXL-USD | $0.31950000 (-3.03%) |

| WAXL-USD | $0.31940000 (-3.24%) |

| MANA-USD | $0.27620000 (-4.43%) |

| XLM-USD | $0.26752200 (-2.43%) |

| STORJ-USD | $0.26750000 (-2.23%) |

| MATIC-USD | $0.21630000 (-0.55%) |

| POL-USD | $0.21620000 (-0.51%) |

| POLS-USD | $0.21580000 (+1.55%) |

| 1INCH-USD | $0.21200000 (-3.64%) |

| MINA-USD | $0.20800000 (-4.59%) |

| OSMO-USD | $0.20740000 (-3.49%) |

| MOODENG-USD | $0.19460000 (-5.44%) |

| SEI-USD | $0.19420000 (-3.14%) |

| ACX-USD | $0.19310000 (-3.26%) |

| ALGO-USD | $0.19210000 (-3.66%) |

| DOG-27JUN25-CDE | $0.19122000 (-2.78%) |

| DOGE-USD | $0.19042000 (-2.82%) |

| ALEO-USD | $0.18500000 (+0.54%) |

| HBAR-USD | $0.16886000 (-2.31%) |

| LRDS-USD | $0.16720000 (+1.27%) |

| FX-USD | $0.16510000 (-3.62%) |

| SYN-USD | $0.16200000 (-5.26%) |

| FIS-USD | $0.14100000 (-10.13%) |

| GODS-USD | $0.13567000 (-4.09%) |

| LCX-USD | $0.13260000 (-3.49%) |

| MAGIC-USD | $0.13080000 (-6.50%) |

| DAR-USD | $0.12900000 (-49.21%) |

| CVC-USD | $0.12440000 (-3.64%) |

| MNDE-USD | $0.12384000 (+1.11%) |

| A8-USD | $0.11850000 (-2.87%) |

| RBN-USD | $0.11638000 (-4.66%) |

| NEON-USD | $0.11543000 (+0.44%) |

| MATH-USD | $0.11110000 (-5.69%) |

| SHDW-USD | $0.10600000 (-3.64%) |

| BICO-USD | $0.10170000 (-3.88%) |

| CRO-USD | $0.10060000 (-0.89%) |

| GRT-USD | $0.09510000 (-3.16%) |

| BOBA-USD | $0.09190000 (-2.23%) |

| PRCL-USD | $0.08900000 (-1.77%) |

| LRC-USD | $0.08830000 (-0.34%) |

| FORT-USD | $0.07380000 (-2.12%) |

| AUDIO-USD | $0.06880000 (-1.99%) |

| FIDA-USD | $0.06750000 (-5.20%) |

| DIMO-USD | $0.06525000 (+0.93%) |

| ALEPH-USD | $0.06460000 (+12.94%) |

| CTSI-USD | $0.06370000 (-2.90%) |

| BIGTIME-USD | $0.06259000 (-3.31%) |

| COTI-USD | $0.05890000 (-2.00%) |

| RARE-USD | $0.05870000 (-2.33%) |

| HFT-USD | $0.05830000 (-4.74%) |

| LOKA-USD | $0.05750000 (-4.33%) |

| ZK-USD | $0.05726000 (-4.22%) |

| OGN-USD | $0.05690000 (-2.37%) |

| VOXEL-USD | $0.05490000 (-6.15%) |

| OXT-USD | $0.05480000 (-3.69%) |

| VELO-USD | $0.05264000 (-1.79%) |

| PIRATE-USD | $0.05170000 (-3.72%) |

| GMT-USD | $0.05100000 (-3.23%) |

| C98-USD | $0.05070000 (-6.80%) |

| KARRAT-USD | $0.04990000 (-0.99%) |

| HOPR-USD | $0.04540000 (-1.94%) |

| PRQ-USD | $0.04350000 (-15.04%) |

| CHZ-USD | $0.03900000 (-3.70%) |

| TRU-USD | $0.03690000 (-3.66%) |

| WELL-USD | $0.03509800 (-4.38%) |

| NKN-USD | $0.02860000 (-5.92%) |

| FOX-USD | $0.02850000 (-3.39%) |

| ROSE-USD | $0.02831000 (-5.51%) |

| DNT-USD | $0.02770000 (+1.84%) |

| IOTX-USD | $0.02584000 (-4.37%) |

| HONEY-USD | $0.02580000 (-0.39%) |

| CLV-USD | $0.02530000 (-1.17%) |

| VET-USD | $0.02387000 (-3.75%) |

| IDEX-USD | $0.02360000 (-4.45%) |

| MDT-USD | $0.02330000 (-14.90%) |

| GIGA-USD | $0.02234000 (-5.06%) |

| ARPA-USD | $0.02180000 (-2.68%) |

| ASM-USD | $0.02165000 (+3.00%) |

| SKL-USD | $0.02140000 (-3.17%) |

| ACH-USD | $0.02098800 (-4.29%) |

| NCT-USD | $0.01940000 (+1.25%) |

| FLR-USD | $0.01786000 (-2.67%) |

| 00-USD | $0.01750000 (-0.57%) |

| ANKR-USD | $0.01672000 (-2.34%) |

| SPA-USD | $0.01601600 (+9.59%) |

| T-USD | $0.01528000 (-3.96%) |

| XCN-USD | $0.01523000 (-6.62%) |

| JASMY-USD | $0.01440000 (-3.55%) |

| G-USD | $0.01328000 (-3.35%) |

| SWFTC-USD | $0.01231300 (-3.51%) |

| XYO-USD | $0.01100000 (-1.96%) |

| SWELL-USD | $0.00938000 (-1.47%) |

| POND-USD | $0.00915000 (-3.28%) |

| QI-USD | $0.00792400 (-1.28%) |

| GST-USD | $0.00750100 (-4.13%) |

| VARA-USD | $0.00591000 (-3.75%) |

| TURBO-USD | $0.00415600 (-3.42%) |

| AMP-USD | $0.00405000 (-2.17%) |

| VTHO-USD | $0.00211300 (-3.12%) |

| TOSHI-USD | $0.00054140 (-2.94%) |

| SPELL-USD | $0.00053650 (-1.03%) |

| MOBILE-USD | $0.00037800 (-5.50%) |

| FLOKI-USD | $0.00008290 (-4.82%) |

| BONK-USD | $0.00001586 (-6.04%) |

| SHIB-USD | $0.00001289 (-1.68%) |

| PEPE-USD | $0.00001204 (-2.82%) |

| MOG-USD | $0.00000090 (-8.16%) |

| Last Updated: | Thursday, June 05, 2025 04:40:51 |

Bot Strategy Analysis

Wambot Transparent analysis

Wambot, the smart trading bot, is powered by twin intelligence (PacoBOT and PacoBAI), combines innovative elements from proven trading strategies, offering a fresh approach to market dynamics. Below is a detailed breakdown of its strengths, weaknesses, and ongoing enhancements.

Strategy Similarities

1. Dollar-Cost Averaging (DCA)

- Dynamic DCA: Buys more when the price drops by a set percentage (d%).

- Triggered by Price Movements: Unlike traditional DCA, it responds to market changes rather than fixed time intervals.

2. Grid Trading

- Dynamic Grid: Buy orders at percentage drops create a flexible grid structure.

- Adaptive Levels: Not fixed, but follows a similar concept of buying at predetermined levels.

3. Mean Reversion

- "Buy the Dip, Sell the Rise": Suggests a belief in price reversion to a mean.

- Flexible Approach: Do not use a strict "mean" definition, making it less rigid than traditional strategies.

4. Martingale (with Caution)

- Controlled Risk: Buys more when the price drops, but uses a fixed amount (n units) to avoid exponential risk. Stop buying/selling at certain points and wait for bottom or top reversals.

- Avoids True Martingale Pitfalls: No doubling down on losing positions.

Strategy Pros and Cons

Pros

- Adaptive DCA: Responds to market fluctuations more effectively than fixed-interval DCA.

- Profit Taking: Clear sell triggers (u%) for locking in gains.

- Risk Management: Pause mechanism limits exposure during prolonged trends.

- Simplicity: Easy to implement and understand.

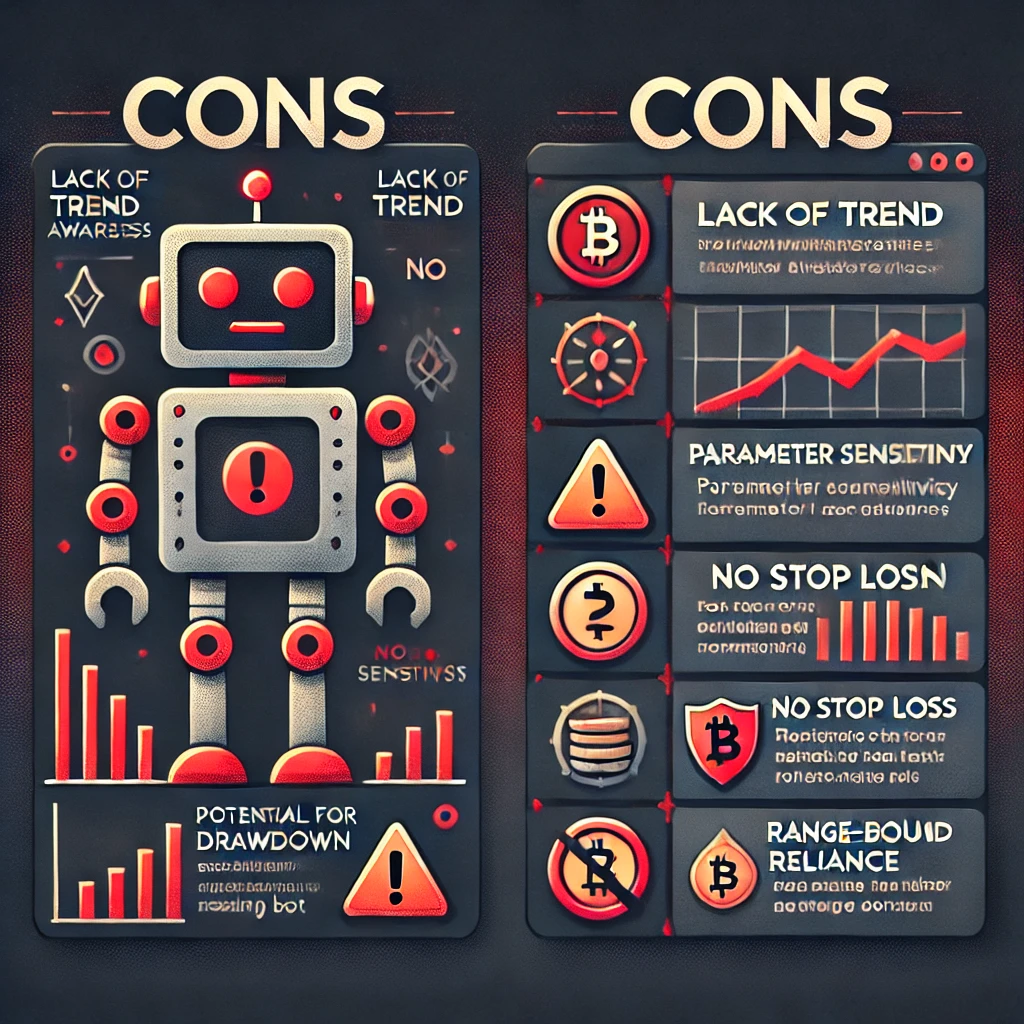

Cons

- Lack of Trend Awareness: May accumulate losses in prolonged downtrends.

- Parameter Sensitivity: Performance heavily depends on buy Drop % and sell increase% values.

- Potential for Drawdown: High volatility could lead to significant losses before selling.

- No Stop Loss: Risk of large drawdowns without a hard stop-loss mechanism.

- Range-Bound Reliance: Performs best in range-bound markets, struggles in strong trends.

Current Enhancements in progress ...

- Trend Indicators: Adding tools like moving averages or RSI to avoid buying into downtrends.

- Dynamic Parameter Adjustment: Adjusting buy and sell size based on market volatility.

- Stop-Loss Orders: Implementing stop-loss mechanisms to limit losses.

- Volume Analysis: Using volume data to confirm trends and improve decision-making.

- Backtesting and Optimization: Rigorous testing to fine-tune parameters and evaluate performance.

In Summary

Wambot is a creative fusion of proven strategies, focusing on adaptive DCA and profit-taking. While it shows promise in certain market conditions, addressing its limitations through enhancements and thorough testing will be key to its success.